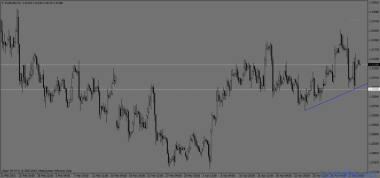

Фиксирую часть позиции, чтобы покрыть предыдущие убытки и удерживаю оставшуюся часть покупки, совершенную на ретесте пятничного локального минимума. Продажи буду рассматривать только при пробитии линии тренда. Входить в позицию необходимо на младшем ТФ, чтобы обеспечить возможность маленького SL. Уровни фиксации прибыли и ограничения убытков определять исходя из собственного подхода. В обзоре обозначены только зоны покупок и уровни продаж.

Наверх

Наверх

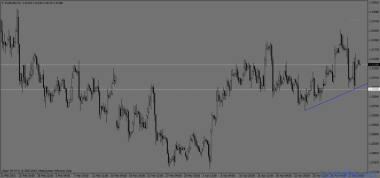

первая сделка,там формация наверно на разворот была..

Май 07 2013, 06:08Первый трейд отличный, а вот второй...

Май 07 2013, 10:31Согласен, формация ближе к развороту, минус, что упала чуть больше доллара, а точка входа только на базе.

Май 07 2013, 14:18Второй вход, Максим, заманили бидом, очень уверенно держали 82 и 83. Не увидел начала движения и на выходе закосячил